We specialise in the management of Alternative Investment Funds.

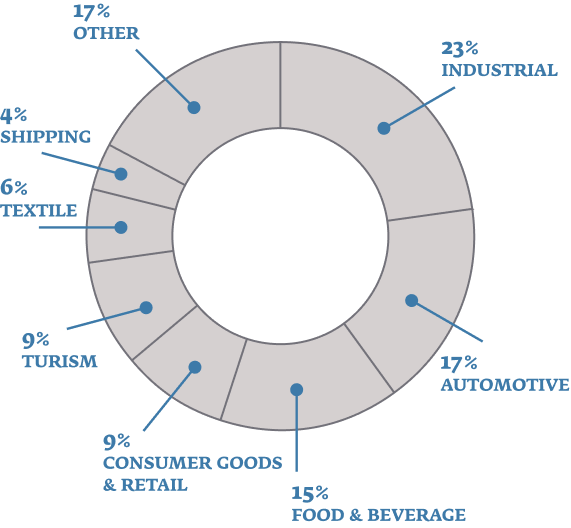

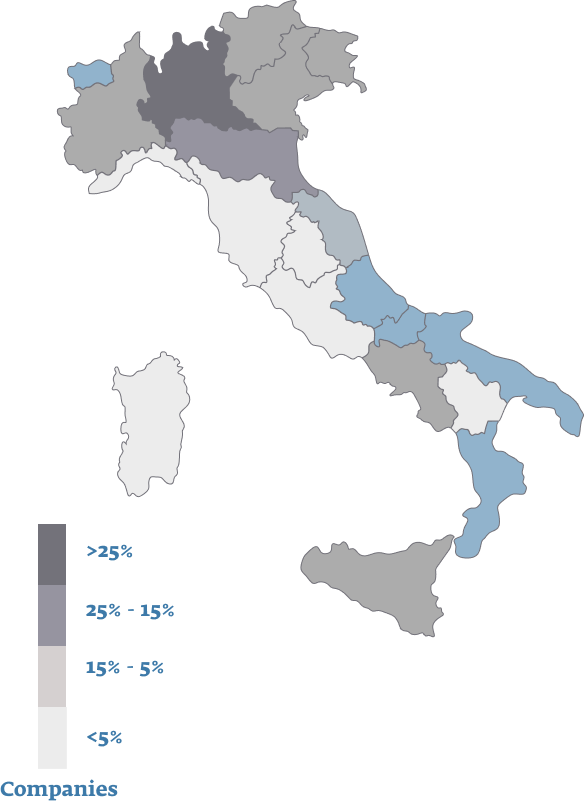

iCCT Fund - illimity Credit & Corporate Turnaround Fund

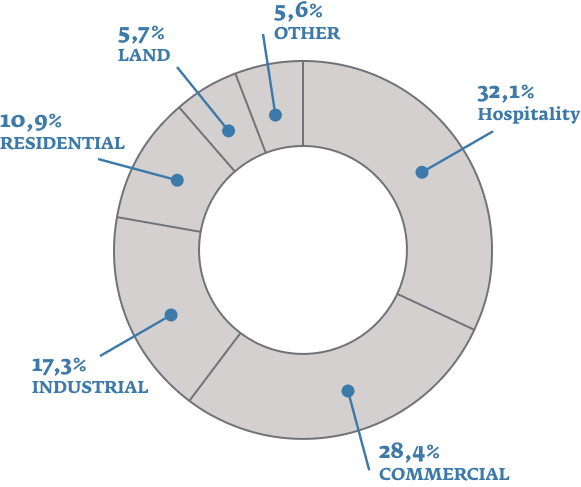

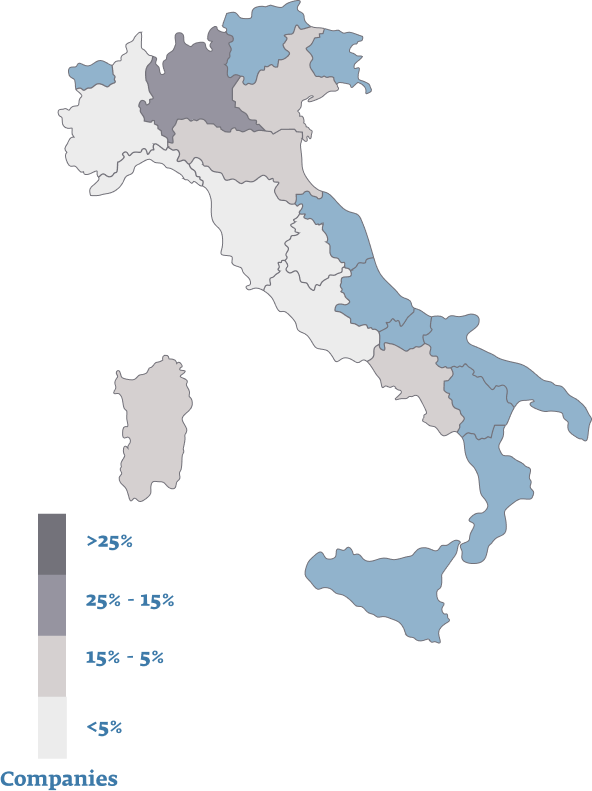

iREC Fund - illimity Real Estate Credit Fund

iSC Fund - illimity Selective Credit Fund

Fürstenberg Società di Gestione del Risparmio S.p.A. | Registered Office: Via Soperga 9 – 20127 Milan | Fully paid-up share capital of EUR 1,000,000.00.

Registered with the Milan Companies Register – REA No. MI 2567666 | Tax Code 10936730968 | Member of the “illimity” VAT Group, VAT No. 12020720962. Registered in the asset management companies register pursuant to Article 35 of the Consolidated Financial Act (TUF) – AIF managers section, No. 183.

A single-member company wholly owned by illimity Bank S.p.A., part of the Banca Ifis S.p.A. Group, registered in the Register of Banking Groups, and subject to the management and coordination of Banca Ifis S.p.A.

© Fürstenberg - All rights reserved